Overview

The UK government has unveiled a £10 billion tax break for workers in a bid to boost the economy and provide relief to the country’s hardworking people. The announcement, made by Finance Secretary Jeremy Hunt, comes just a few months before the upcoming national election. Here’s what you need to know about the tax cut and how it will affect you.

Table of Contents

The Tax Cut

National Insurance Reduction:

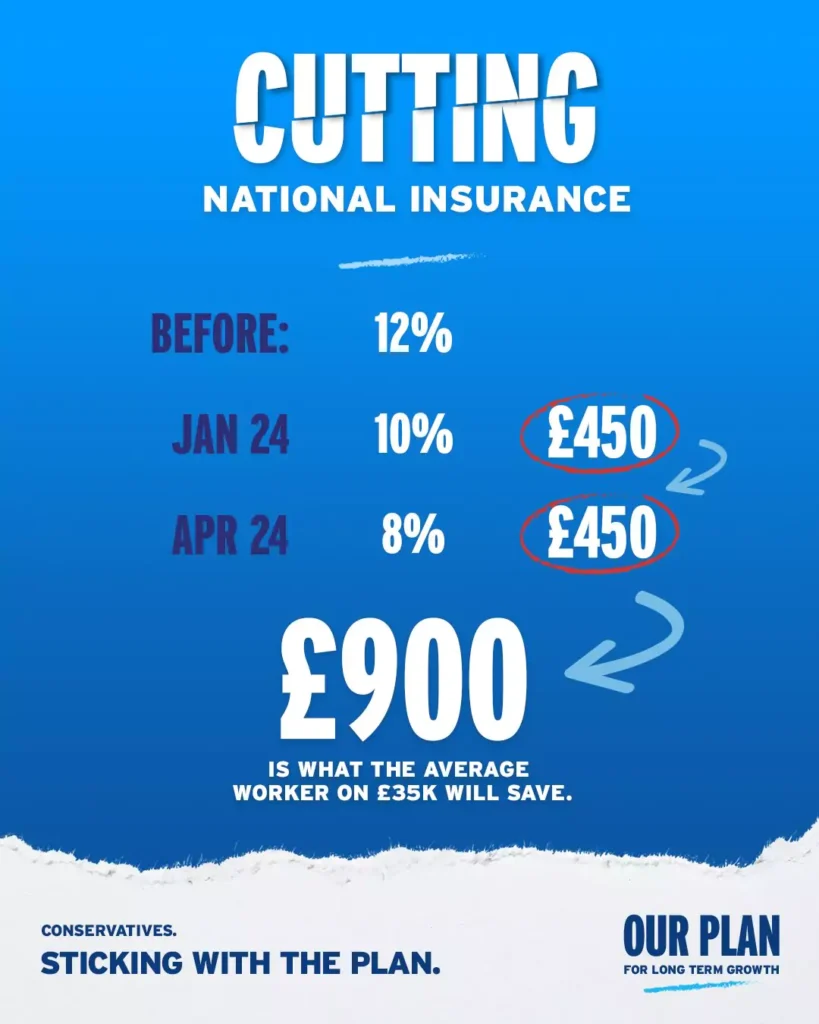

The main component of this tax cut is a reduction in the National Insurance rate. National Insurance is the payroll tax paid by employees and employers. Beginning in April, the National Insurance rate will be reduced by two percentage points. This is similar to what Hunt did in November. This shows that the government is committed to reducing the tax burden on workers.

Impact on Workers:

Around 27 million workers across the UK will benefit from the tax cut. For working people, this could mean saving up to £330 per year. In addition, 2.2 million people will avoid paying any personal tax at all.

From £9,880, the threshold for starting to pay National Insurance has been increased to £12,570. This means that 70% of UK workers will pay less National Insurance. This figure does not take into account the Health and social care Levy, which pays for the NHS’s catch-up programme and helps to contain rising social care costs.

Industry-Specific Impact:

Workers in different industries benefit from the new threshold. Take a look at the following examples:

Bricklayers: Savings of £218 annually.

Care Workers: A welcome £324 reduction.

Hairdressers: An extra £118 in their pockets.

Nursery Assistants: A yearly boost of £343.

Historical Significance

A Decade-Long Milestone:

Today’s tax cut is the biggest personal tax reduction in almost 10 years. The last time there was a personal tax increase was in 2013 when the personal allowance for income tax went up by £1,000. Today’s threshold change goes further than that, allowing working people to keep an extra £2,690 free of tax.

Wider Vision for a Lower Tax Economy:

The tax cut isn’t the only part of Chancellor Hunt’s plan. In his Spring Statement, he declared a 1p income tax cut planned for 2024 – the first basic rate reduction in 16 years, saving the average taxpayer an additional £175 a year.

In addition, the government intends to implement a business tax reform later this year to encourage business growth and efficiency.

Conclusion

The UK’s £10 billion workers’ tax cut is a win-win for the UK economy, rewarding hard work and delivering much-needed tax relief. With the government continuing to work towards a lower tax base, workers can expect a better financial future.

Also Read:

Chicago Bears Free Agency: Top Targets for 2024

Kylie Kelce Breaks Silence on Jason Kelce’s Retirement! : A Perfect Summary of His NFL Career

Steve Garvey Advances in California Senate Primary: Key Takeaways

2024 Sea.Hear.Now Festival Lineup: A Harmonious Blend of Music and Surfing

Follow these social media links: